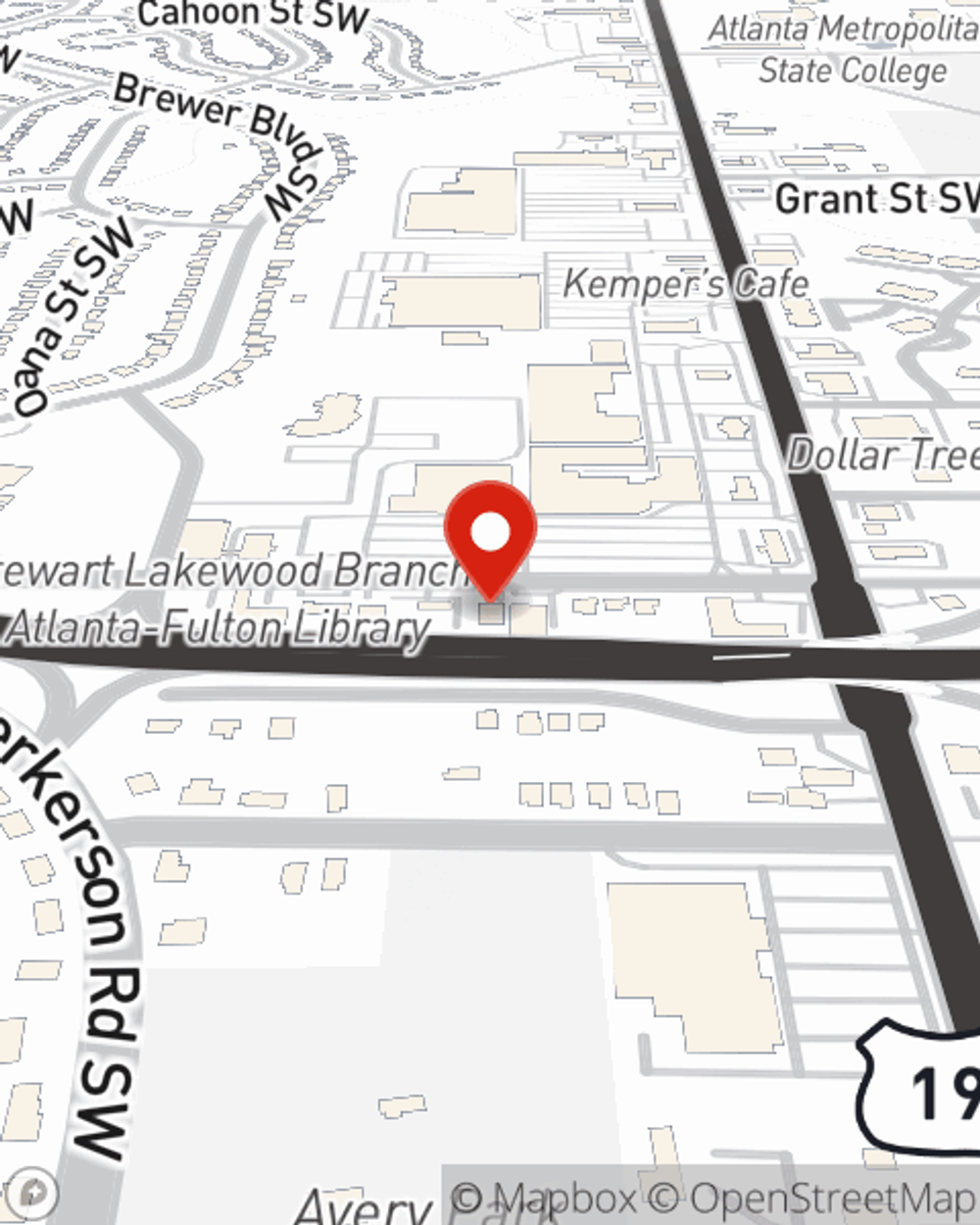

Business Insurance in and around Atlanta

One of Atlanta’s top choices for small business insurance.

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, business continuity plans, and a surety or fidelity bond.

One of Atlanta’s top choices for small business insurance.

Almost 100 years of helping small businesses

Cover Your Business Assets

Whether you own a dry cleaner, cosmetic store or a HVAC company, State Farm is here to help. Aside from great service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by getting in touch with agent Kwame Tyler's team to learn more about your options.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Kwame Tyler

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.