Homeowners Insurance in and around Atlanta

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Committing to homeownership is a big deal. You need to consider home layout location and more. But once you find the perfect place to call home, you also need outstanding insurance. Finding the right coverage can help your Atlanta home be a sweet place to be.

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Open The Door To The Right Homeowners Insurance For You

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s personalized to match your specific needs. Luckily you won’t have to figure that out alone. With personal attention and outstanding customer service, Agent Kwame Tyler can walk you through every step to create a policy that shields your home and everything you’ve invested in.

Your home is the place where your loved ones gather, but unfortunately, the unpredictable circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Kwame Tyler can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Kwame at (404) 524-2292 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

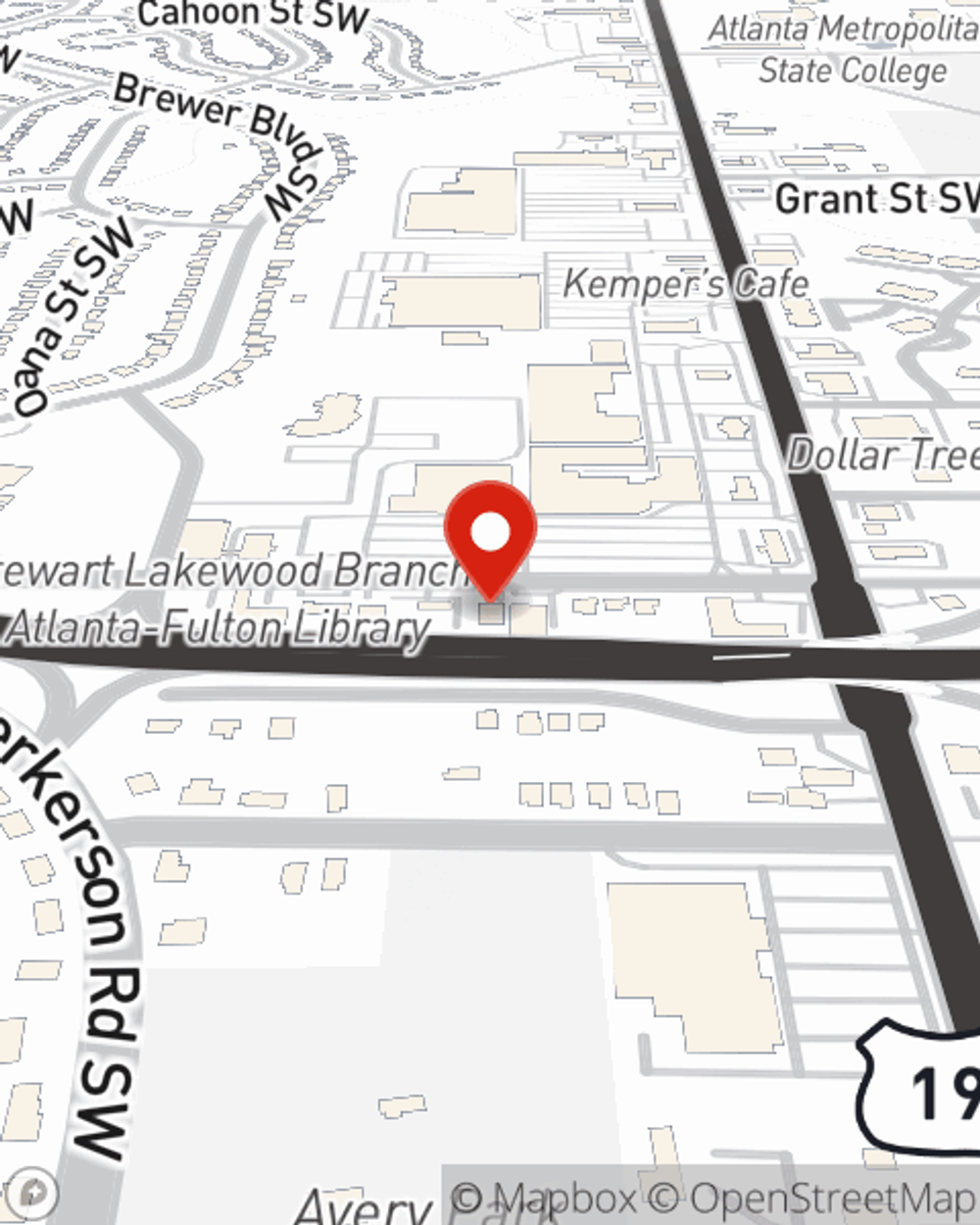

Kwame Tyler

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.